Global Frozen Pizza Market: Information by Crust Type (Thin Crust, Pan, Stuffed Crust, and Others), By Category (Gluten-Free, and Conventional), By Size (Regular, Medium, and Large), By Distribution Channel (Store-Based [Supermarkets & Hypermarkets, Convenience Stores, and Specialty Stores] and Non-Store-Based) and Region (North America, Europe, Asia-Pacific, and Rest of the World)—Forecast till 2028

Date: Jun-2022 | Global

Frozen Pizza Market Overview

Frozen pizza market is projected to register a CAGR of 5.62% and reach a value of USD 18,424.4 million by 2028. Frozen pizza is referred to the half-baked pizza prepared by yeasted flatbread dough, which is typically topped with various types of fruits, vegetables, and meat. Frozen pizza is usually stored at a controlled temperature under 0 degree to preserve it for later consumption. Frozen pizza has a longer shelf life, owing to its low-temperature condition and preservatives used for increasing the shelf-life. The global frozen pizza market has witnessed rapid growth over the last few years and is projected to expand at a CAGR of 5.62% during the forecast period. Increasing consumer preference towards convenience foods is anticipated to act as a major driver in the growth of the global frozen pizza market during the forecast period. Additionally, the growth of the organized retail sector is expected to positively influence the sales of frozen pizza at the global level. However, frozen pizza is not cost-efficient for the consumers, which is anticipated to restrict the growth of the market. The development of the cold chain industry in the emerging economies is expected to create a lucrative opportunity for the manufacturers of frozen pizza.

COVID-19 Impact Analysis

The rapid proliferation of the COVID-19 pandemic has resulted in a global crisis. Impacting over 195 countries, the pandemic has already created an economic downfall worldwide. The global pandemic is deemed to create a chaotic environment, resulting in a global recession. With the rapidly increasing number of cases, the global frozen pizza market is getting affected in many ways.

The outbreak of COVID-19 has resulted in creating immense pressure across supermarkets & hypermarkets, convenience stores, and food suppliers, globally. This has led to an increased sale of convenience foods such as frozen pizza, as the consumers are stockpiling of shelf-stable foods. The stockpiling practice has led to a sudden hike in the market value of the global frozen pizza market in 2020 which will normalize post the stabilization from this outbreak. However, the lack of availability of frozen bakery product stocks in retail stores is currently one of the biggest concerns across the world.

Some of the pizza manufacturers are hiring personnel to keep up with the demand for the products as consumers are stockpiling comfort foods to get them through the pandemic. For instance, according to the American Bakers Association (ABA), the North American bakery industry is scaling up the workforce to meet the demand for fresh and frozen pizza. However, the biggest concern that remains is logistics. With the increasing number of COVID-19 infections globally, restrictions on vehicular movement are increasing. This is creating a demand and supply gap, thereby resulting in empty shelves in various retail outlets in many American and European countries.

Market Dynamics

The global frozen pizza market has witnessed significant growth over the last few years and is projected to register a 5.62% CAGR during the forecast period. The key drivers fueling the growth of the global frozen pizza market are the rising demand for convenience food, the increasing number of working women, and the rapid growth of the organized retail sector. However, the high price of the product is set to curb the growth of the global frozen pizza market. Nevertheless, the increasing investments in the cold chain market in developing countries and the growing demand for organic products are expected to create lucrative opportunities for players operating in the global frozen pizza market during the forecast period

Drivers:- Rising Demand For Convenience Food

The changing lifestyles, evolving dietary patterns, and availability of convenience food are factors that play an important role in defining the consumer’s food choices. The growing trend of consuming convenience food began in the western world and rapidly spread to other regions across the globe. Consumers prefer convenience foods as they are easy to consume and have nutritional value, variety, and product appeal. Due to changing lifestyles, consumers are spending less time planning and cooking meals at home, as they consider preparing food at home to be a time and energy-consuming process. The increasing consumption of convenience food is driven by the need to create more leisure time, which means that consumers look for options that would help them maximize their free time, doing the things they value more. This, along with the increasing per capita disposable income, is expected to increase the demand for frozen pizza. Frozen consumables are considered convenient as there is no need to put in a lot of effort to make these products edible. Frozen pizza can be prepared by simply heating the product in a microwave or oven. Thus, the rising demand for convenience food is expected to drive the growth of the global frozen pizza market during the review period..

Restraint:- High Production Cost

Frozen pizza is generally costlier compared to freshly baked pizza. The manufacturers of frozen pizza are pricing their products higher as compared to fresh pizza owing to the costly production and storage process. Furthermore, this is not the only product available in the global market. Consumers can opt for fresh and other types of convenience foods, which are healthier in comparison to pizza. The oligopolistic market includes individual producers that are involved in price wars and charging prices according to their choice.

Opportunities:- Development of the Cold Chain Market in Emerging Economies

Liberalization, globalization, and growth of international trade, coupled with government support towards infrastructure development for the cold chain sector, are factors that have created growth and investment opportunities in multiple markets. The cold chain logistics market in developing countries is dynamic and constantly evolving. Due to the current demand-supply gap in the global market, the fragmented cold chain logistics market offers ample opportunities for new entrants to enter the market. Furthermore, cold storage is also a crucial factor and key component of food trade in various countries. Operations in the cold chain market have substantially improved in recent decades.

Segment Overview

By Crust Type

Based on crust type, the global frozen pizza market has been segmented into thin crust, pan, stuffed crust, and others. The thin segment accounted for the largest market share of 48.55% in 2020 and is projected to register a CAGR of 5.64% during the forecast period, while the stuffed crust segment is expected to exhibit the highest CAGR of 6.30% during the review period.

By Category

Based on the category, the global frozen pizza market has been segmented into gluten-free and conventional. The conventional segment accounted for a larger market share 84.16% in 2020 and is projected to register a CAGR of 5.52% during the forecast period, while the gluten-free segment is expected to exhibit a higher CAGR of 6.14% during the review period.

By Size

Based on the size, the global frozen pizza market has been segmented into regular, medium, and large. The regular segment accounted for the largest market share of 52.18% in 2020 and is projected to register a CAGR of 5.67% during the forecast period, while the large segment is expected to exhibit the highest CAGR of 5.81% during the review period.

By Distribution Channel

Based on the distribution channel, the global frozen pizza market has been segmented into store-based and non-store-based. The Store-based channel is further segmented into supermarkets & hypermarkets, convenience stores, and others. The store-based segment accounted for a largest market share in 2020 and is projected to register a CAGR of 5.44% during the forecast period, while the non-store-based segment is expected to exhibit a higher CAGR of 6.41% during the review period..

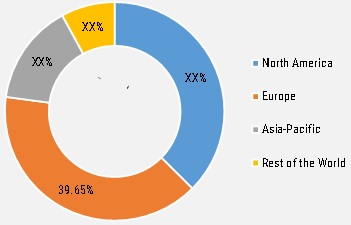

Global Frozen pizza Market Share, by Region, 2020 (%)

Sources: MACRC Analysis

Regional Analysis

By region, the global frozen pizza market has been divided into North America, Europe, Asia-Pacific, and the Rest of the World. Europe accounted for the largest market share of 39.65% in 2020. North America was the second-largest market in 2020 and is projected to exhibit a CAGR of 5.71% during the review period. The market in the Rest of the World is expected to register a CAGR of 4.68% during the forecast period.

Europe

Europe accounted for the largest share of 39.65% of the global frozen pizza market in 2020. The regional market is expected to register a CAGR of 5.56% during the forecast period. The growth of the frozen pizza market in the European region is attributed to several factors. Premiumization is one of the major trends gaining traction in European countries. The consumers are opting for healthy pizza that contain whole grain, have high fiber content and are gluten-free. Also, the increasing consumer inclination towards convenience foods due to busy lifestyles is anticipated to act as a major driver in the growth of the European frozen pizza market. Moreover, consumers are increasingly opting for clean label products. Clean label ingredients are widely used in the manufacture of these products for visual appeal. According to the US Department of Agriculture (USDA), the sales of organic packaged food in Europe were valued at 34.37 billion in 2020. The consumption of organic food & beverages is especially high in Western European countries such as the UK, Germany, and France. Additionally, the manufacturers of frozen pizza have adopted expansion strategies to increase their presence across the European region. For instance, in September 2016, La Lorraine Bakery Group opened its production plant in Turkey. The new production plant caters to the increasing demand for frozen pizza across Turkey and Eastern Europe..

North America

North America has accounted for a market share of 37.47% of the global frozen pizza market in 2020 and is projected to expand at a CAGR of 5.71% during the forecast period of 2021-2028. The frozen pizza market in North America has been experiencing rapid growth over the last few years. The growth can be attributed to the increasing consumer inclination towards ready-to-eat food products.

Competitive Landscape

The market comprises tier-1 players along with some local players with diverse product portfolios. Companies such as Nestlé S.A. (Switzerland), McCain Foods Limited (Canada), Dr. Oetker GmbH (Germany), Daiya Foods Inc. (Canada), Palermo Villa, Inc. (US), dominate the market due to brand reputation, product differentiation, financial stability, and strong distribution network. The players are focused on lowering their environmental footprint and investing in research and development along with strategic growth initiatives such as acquisitions and product launches to strengthen their market position and capture a large consumer base.

Prominent players in the global frozen pizza market include Nestlé S.A. (Switzerland), McCain Foods Limited (Canada), Dr. Oetker GmbH (Germany), Daiya Foods Inc. (Canada), Palermo Villa, Inc. (US), The Simply Good Foods Company (US), California Pizza Kitchen, Inc. (US), General Mills Inc.(US), Hansen Foods LLC(US), and Conagra Brands, Inc.(US).

Recent Developments

Few developments that occurred in recent times influencing the market growth of frozen pizza are listed below:

- In June 2021, Dr. Oetker GmbH announced the launch of its first vegan Ristorante frozen pizza in UK. The Ristorante Margherita Pomodori pizza has a thin, crispy crust and features vegan cheese alternative.

- In November 2021, California pizza kitchen announces the Canadian expansion plans in Vancouver, BC, and Toronto, Ontario, with select franchise partners. This expansion will help to improve overall operations to be a more productive and efficient way to increase overall capacity.

- In August 2021, General Mills Inc. announces the expansion its facility in Sharonville, Ohio. This will help the company to create more jobs while updating its building and equipment.

- In April 2020, Daiya Foods Inc. announced the launch of its new plant-based foods, including new gluten-free, thin crust pizzas.

- In October 2018, Conagra Brands, Inc. acquired Pinnacle Foods Inc., a New Jersey, US-based packaged foods company. The acquisition resulted in strengthening the company’s gluten-free bakery and frozen foods products portfolio.

Scope of the Report

Global Frozen pizza Market, by Crust Type

- Thin

- Pan

- Stuffed Crust

- others

Global Frozen pizza Market, by Category

- Conventional

- Gluten-Free

Global Frozen pizza Market, by Size

- Regular

- Medium

- Large

Global Frozen pizza Market, by Distribution Channel

- Store-Based

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Non-Store-Based

Global Frozen pizza Market, by Region

- North America

- US

- Canada

- Mexico

- Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

- Asia-Pacific

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia-Pacific

- Rest of the World

- South America

- Middle East

- Africa

Intended Audience

- Frozen pizza Manufacturers

- Raw Material Suppliers

- Retailers, Wholesalers, and Distributors

- Governments, Associations, and Industrial Bodies

- Investors and Trade Experts

TABLE OF CONTENTS 1 EXECUTIVE SUMMARY 16 1.1 MARKET ATTRACTIVENESS ANALYSIS 17 1.1.1 GLOBAL FROZEN PIZZA MARKET, BY CRUST TYPE 18 1.1.2 GLOBAL FROZEN PIZZA MARKET, CATEGORY 19 1.1.3 GLOBAL FROZEN PIZZA MARKET, SIZE 20 1.1.4 GLOBAL FROZEN PIZZA MARKET, DISTRIBUTION CHANNEL 21 1.1.5 GLOBAL FROZEN PIZZA MARKET, BY REGION 22 2 MARKET INTRODUCTION 23 2.1 DEFINITION 23 2.2 SCOPE OF THE STUDY 23 2.3 RESEARCH OBJECTIVE 23 2.4 MARKET STRUCTURE 24 2.5 KEY BUYING CRITERIA 24 3 RESEARCH METHODOLOGY 25 3.1 RESEARCH PROCESS 25 3.2 PRIMARY RESEARCH 26 3.3 SECONDARY RESEARCH 27 3.4 MARKET SIZE ESTIMATION 28 3.5 FORECAST MODEL 29 3.6 LIST OF ASSUMPTIONS & LIMITATIONS 30 4 MARKET DYNAMICS 31 4.1 INTRODUCTION 31 4.2 DRIVERS 32 4.2.1 RISING DEMAND FOR CONVENIENCE FOOD 32 4.2.2 INCREASING NUMBER OF WORKING WOMEN 32 4.2.3 GROWTH OF THE ORGANIZED RETAIL SECTOR IN ASIA-PACIFIC 32 4.3 RESTRAINT 34 4.3.1 HIGH PRODUCT COST 34 4.4 OPPORTUNITIES 35 4.4.1 DEVELOPMENT OF THE COLD CHAIN MARKET IN EMERGING ECONOMIES 35 4.4.2 DEMAND FOR ORGANIC PRODUCTS 35 4.5 CHALLENGE 35 4.5.1 BRANDING ISSUES 35 5 MARKET FACTOR ANALYSIS 36 5.1 VALUE CHAIN ANALYSIS 36 5.1.1 RAW MATERIAL PROCUREMENT 37 5.1.2 PROCESSING 37 5.1.3 PACKAGING 37 5.2 SUPPLY CHAIN ANALYSIS 38 5.3 PORTER’S FIVE FORCES MODEL 39 5.3.1 THREAT OF NEW ENTRANTS 39 5.3.2 BARGAINING POWER OF SUPPLIERS 40 5.3.3 BARGAINING POWER OF BUYERS 40 5.3.4 THREAT OF SUBSTITUTES 40 5.3.5 INTENSITY OF RIVALRY 40 6 IMPACT OF THE COVID-19 OUTBREAK ON THE GLOBAL FROZEN PIZZA MARKET 41 7 GLOBAL FROZEN PIZZA MARKET, BY CRUST TYPE 42 7.1 OVERVIEW 42 7.1.1 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY CRUST TYPE, 2019–2028 43 7.2 THIN 43 7.2.1 THIN: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 43 7.3 PAN 44 7.3.1 PAN: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 44 7.4 STUFFED CRUST 45 7.4.1 STUFFED CRUST: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 45 7.5 OTHERS 46 7.5.1 OTHERS: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 46 8 GLOBAL FROZEN PIZZA MARKET, BY CATEGORY 47 8.1 OVERVIEW 47 8.1.1 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY CATEGORY, 2019–2028 48 8.2 CONVENTIONAL 48 8.2.1 CONVENTIONAL: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 48 8.3 GLUTEN-FREE 49 8.3.1 GLUTEN-FREE: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 49 9 GLOBAL FROZEN PIZZA MARKET, BY SIZE 50 9.1 OVERVIEW 50 9.1.1 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY SIZE, 2019–2028 51 9.2 REGULAR 51 9.2.1 REGULAR: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 51 9.3 MEDIUM 52 9.3.1 MEDIUM: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 52 9.4 LARGE 53 9.4.1 LARGE: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 53 10 GLOBAL FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL 54 10.1 OVERVIEW 54 10.1.1 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019–2028 55 10.2 STORE-BASED 56 10.2.1 STORE-BASED: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 56 10.3 NON-STORE-BASED 57 10.3.1 NON-STORE-BASED: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 57 11 GLOBAL FROZEN PIZZA MARKET, BY REGION 58 11.1 OVERVIEW 58 11.2 NORTH AMERICA 60 11.2.1 US 62 11.2.2 CANADA 64 11.2.3 MEXICO 65 11.3 EUROPE 67 11.3.1 UK 70 11.3.2 GERMANY 71 11.3.3 FRANCE 73 11.3.4 ITALY 74 11.3.5 SPAIN 76 11.3.6 REST OF EUROPE 77 11.4 ASIA-PACIFIC 79 11.4.1 CHINA 81 11.4.2 INDIA 83 11.4.3 JAPAN 84 11.4.4 AUSTRALIA & NEW ZEALAND 86 11.4.5 REST OF ASIA-PACIFIC 87 11.5 REST OF THE WORLD 90 11.5.1 SOUTH AMERICA 92 11.5.2 MIDDLE EAST 94 11.5.3 AFRICA 95 12 COMPETITIVE LANDSCAPE 97 12.1 INTRODUCTION 97 12.1.1 MARKET STRATEGY ANALYSIS 97 12.2 COMPETITIVE BENCHMARKING 98 12.3 KEY DEVELOPMENTS & GROWTH STRATEGIES 99 12.3.1 PRODUCT LAUNCH 99 12.3.2 ACQUISITION 99 12.3.3 EXPANSION 100 13 COMPANY PROFILES 101 13.1 NESTLÉ S.A. 101 13.1.1 COMPANY OVERVIEW 101 13.1.2 FINANCIAL OVERVIEW 102 13.1.3 PRODUCTS OFFERED 102 13.1.4 KEY DEVELOPMENTS 103 13.1.5 SWOT ANALYSIS 103 13.1.6 KEY STRATEGIES 104 13.2 MCCAIN FOODS LIMITED 105 13.2.1 COMPANY OVERVIEW 105 13.2.2 FINANCIAL OVERVIEW 105 13.2.3 PRODUCTS OFFERED 105 13.2.4 KEY DEVELOPMENTS 106 13.2.5 SWOT ANALYSIS 107 13.2.6 KEY STRATEGIES 107 13.3 DR. OETKER GMBH 108 13.3.1 COMPANY OVERVIEW 108 13.3.2 FINANCIAL OVERVIEW 108 13.3.3 PRODUCTS OFFERED 108 13.3.4 KEY DEVELOPMENTS 110 13.3.5 SWOT ANALYSIS 110 13.3.6 KEY STRATEGIES 111 13.4 DAIYA FOODS INC. 112 13.4.1 COMPANY OVERVIEW 112 13.4.2 FINANCIAL OVERVIEW 112 13.4.3 PRODUCTS OFFERED 112 13.4.4 KEY DEVELOPMENTS 113 13.4.5 SWOT ANALYSIS 113 13.4.6 KEY STRATEGIES 113 13.5 PALERMO VILLA, INC. 114 13.5.1 COMPANY OVERVIEW 114 13.5.2 FINANCIAL OVERVIEW 114 13.5.3 PRODUCTS OFFERED 114 13.5.4 KEY DEVELOPMENTS 115 13.5.5 SWOT ANALYSIS 116 13.5.6 KEY STRATEGIES 116 13.6 THE SIMPLY GOOD FOODS COMPANY 117 13.6.1 COMPANY OVERVIEW 117 13.6.2 FINANCIAL OVERVIEW 118 13.6.3 PRODUCTS OFFERED 118 13.6.4 KEY DEVELOPMENTS 119 13.6.5 SWOT ANALYSIS 119 13.6.6 KEY STRATEGIES 119 13.7 GENERAL MILLS INC. 120 13.7.1 COMPANY OVERVIEW 120 13.7.2 FINANCIAL OVERVIEW 120 13.7.3 PRODUCTS/SERVICES OFFERED 121 13.7.4 KEY DEVELOPMENTS 121 13.7.5 SWOT ANALYSIS 121 13.7.6 KEY STRATEGIES 122 13.8 CONAGRA BRANDS, INC. 123 13.8.1 COMPANY OVERVIEW 123 13.8.2 FINANCIAL OVERVIEW 124 13.8.3 PRODUCTS/SERVICES OFFERED 125 13.8.4 KEY DEVELOPMENTS 125 13.8.5 SWOT ANALYSIS 126 13.8.6 KEY STRATEGIES 126 13.9 CALIFORNIA PIZZA KITCHEN, INC. 127 13.9.1 COMPANY OVERVIEW 127 13.9.2 FINANCIAL OVERVIEW 127 13.9.3 PRODUCTS/SERVICES OFFERED 127 13.9.4 KEY DEVELOPMENTS 128 13.9.5 KEY STRATEGIES 128 13.10 HANSEN FOODS, LLC 129 13.10.1 COMPANY OVERVIEW 129 13.10.2 FINANCIAL OVERVIEW 129 13.10.3 PRODUCTS/SERVICES OFFERED 129 13.10.4 KEY DEVELOPMENTS 130 13.10.5 KEY STRATEGIES 130 14 REFERENCES 131 LIST OF TABLES TABLE 1 PRIMARY INTERVIEWS 26 TABLE 2 LIST OF ASSUMPTIONS & LIMITATIONS 30 TABLE 3 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY CRUST TYPE, 2019–2028 (USD MILLION) 43 TABLE 4 THIN: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 43 TABLE 5 PAN: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 44 TABLE 6 STUFFED CRUST: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 45 TABLE 7 OTHERS: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 46 TABLE 8 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY CATEGORY, 2019–2028 (USD MILLION) 48 TABLE 9 CONVENTIONAL: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 48 TABLE 10 GLUTEN-FREE: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 49 TABLE 11 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY SIZE, 2019–2028 (USD MILLION) 51 TABLE 12 REGULAR: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 51 TABLE 13 MEDIUM: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 52 TABLE 14 LARGE: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 53 TABLE 15 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 55 TABLE 16 STORE-BASED: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 56 TABLE 17 NON-STORE-BASED: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 57 TABLE 18 GLOBAL FROZEN PIZZA MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 59 TABLE 19 NORTH AMERICA: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2019–2028 (USD MILLION) 60 TABLE 20 NORTH AMERICA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 61 TABLE 21 NORTH AMERICA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 61 TABLE 22 NORTH AMERICA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 61 TABLE 23 NORTH AMERICA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 62 TABLE 24 US: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 62 TABLE 25 US: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 63 TABLE 26 US: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 63 TABLE 27 US: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 63 TABLE 28 CANADA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 64 TABLE 29 CANADA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 64 TABLE 30 CANADA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 64 TABLE 31 CANADA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 65 TABLE 32 MEXICO: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 65 TABLE 33 MEXICO: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 66 TABLE 34 MEXICO: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 66 TABLE 35 MEXICO: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 66 TABLE 36 EUROPE: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2019–2028 (USD MILLION) 68 TABLE 37 EUROPE: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 68 TABLE 38 EUROPE: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 69 TABLE 39 EUROPE: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 69 TABLE 40 EUROPE: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 69 TABLE 41 UK: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 70 TABLE 42 UK: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 70 TABLE 43 UK: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 70 TABLE 44 UK: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 71 TABLE 45 GERMANY: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 71 TABLE 46 GERMANY: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 72 TABLE 47 GERMANY: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 72 TABLE 48 GERMANY: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 72 TABLE 49 FRANCE: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 73 TABLE 50 FRANCE: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 73 TABLE 51 FRANCE: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 73 TABLE 52 FRANCE: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 74 TABLE 53 ITALY: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 74 TABLE 54 ITALY: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 75 TABLE 55 ITALY: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 75 TABLE 56 ITALY: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 75 TABLE 57 SPAIN: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 76 TABLE 58 SPAIN: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 76 TABLE 59 SPAIN: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 76 TABLE 60 SPAIN: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 77 TABLE 61 REST OF EUROPE: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 77 TABLE 62 REST OF EUROPE: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 78 TABLE 63 REST OF EUROPE: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 78 TABLE 64 REST OF EUROPE: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 78 TABLE 65 ASIA-PACIFIC: MARKET ESTIMATES & FORECAST, BY COUNTRY, 2019–2028 (USD MILLION) 79 TABLE 66 ASIA-PACIFIC: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 80 TABLE 67 ASIA-PACIFIC: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 80 TABLE 68 ASIA-PACIFIC: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 80 TABLE 69 ASIA-PACIFIC: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 81 TABLE 70 CHINA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 81 TABLE 71 CHINA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 82 TABLE 72 CHINA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 82 TABLE 73 CHINA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 82 TABLE 74 INDIA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 83 TABLE 75 INDIA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 83 TABLE 76 INDIA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 83 TABLE 77 INDIA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 84 TABLE 78 JAPAN: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 84 TABLE 79 JAPAN: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 85 TABLE 80 JAPAN: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 85 TABLE 81 JAPAN: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 85 TABLE 82 AUSTRALIA & NEW ZEALAND: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 86 TABLE 83 AUSTRALIA & NEW ZEALAND: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 86 TABLE 84 AUSTRALIA & NEW ZEALAND: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 86 TABLE 85 AUSTRALIA & NEW ZEALAND: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 87 TABLE 86 REST OF ASIA-PACIFIC: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 87 TABLE 87 REST OF ASIA-PACIFIC: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 88 TABLE 88 REST OF ASIA-PACIFIC: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 88 TABLE 89 REST OF ASIA-PACIFIC: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 89 TABLE 90 REST OF THE WORLD: MARKET ESTIMATES & FORECAST, BY REGION, 2019–2028 (USD MILLION) 90 TABLE 91 REST OF THE WORLD: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 91 TABLE 92 REST OF THE WORLD: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 91 TABLE 93 REST OF THE WORLD: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 91 TABLE 94 REST OF THE WORLD: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 92 TABLE 95 SOUTH AMERICA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 92 TABLE 96 SOUTH AMERICA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 93 TABLE 97 SOUTH AMERICA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 93 TABLE 98 SOUTH AMERICA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 93 TABLE 99 MIDDLE EAST: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 94 TABLE 100 MIDDLE EAST: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 94 TABLE 101 MIDDLE EAST: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 94 TABLE 102 MIDDLE EAST: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 95 TABLE 103 AFRICA: FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 95 TABLE 104 AFRICA: FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 96 TABLE 105 AFRICA: FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 96 TABLE 106 AFRICA: FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 96 TABLE 107 PRODUCT LAUNCH 99 TABLE 108 ACQUISITION 99 TABLE 109 EXPANSION 100 TABLE 110 NESTLÉ S.A.: PRODUCTS OFFERED 102 TABLE 111 NESTLÉ S.A.: KEY DEVELOPMENTS 103 TABLE 112 MCCAIN FOODS LIMITED: PRODUCTS/SERVICES OFFERED 105 TABLE 113 MCCAIN FOODS LIMITED: KEY DEVELOPMENTS 106 TABLE 114 DR. OETKER GMBH: PRODUCTS OFFERED 108 TABLE 115 DR. OETKER GMBH: KEY DEVELOPMENTS 110 TABLE 116 DAIYA FOODS INC.: PRODUCTS/SERVICES OFFERED 112 TABLE 117 DAIYA FOODS INC.: KEY DEVELOPMENTS 113 TABLE 118 PALERMO VILLA, INC.: PRODUCTS OFFERED 114 TABLE 119 PALERMO VILLA, INC.: KEY DEVELOPMENTS 115 TABLE 120 THE SIMPLY GOOD FOODS COMPANY: PRODUCTS/SERVICES OFFERED 118 TABLE 121 THE SIMPLY GOOD FOODS COMPANY: KEY DEVELOPMENTS 119 TABLE 122 GENRAL MILLS INC.: PRODUCTS/SERVICES OFFERED 121 TABLE 123 CONAGRA BRANDS, INC.: PRODUCTS/SERVICES OFFERED 125 TABLE 124 CALIFORNIA PIZZA KITCHEN, INC.: PRODUCTS OFFERED 127 TABLE 125 LOVE STRUCK: PRODUCTS/SERVICES OFFERED 129 LIST OF FIGURES FIGURE 1 MARKET SYNOPSIS 16 FIGURE 2 MARKET ATTRACTIVENESS ANALYSIS: GLOBAL FROZEN PIZZA MARKET, 2020 17 FIGURE 3 GLOBAL FROZEN PIZZA MARKET ANALYSIS, BY CRUST TYPE, 2020 18 FIGURE 4 GLOBAL FROZEN PIZZA MARKET ANALYSIS, BY CATEGORY, 2020 19 FIGURE 5 GLOBAL FROZEN PIZZA MARKET ANALYSIS, BY SIZE, 2020 20 FIGURE 6 GLOBAL FROZEN PIZZA MARKET ANALYSIS, BY DISTRIBUTION CHANNEL, 2020 21 FIGURE 7 GLOBAL FROZEN PIZZA MARKET ANALYSIS, BY REGION, 2020 22 FIGURE 8 GLOBAL FROZEN PIZZA MARKET: STRUCTURE 24 FIGURE 9 KEY BUYING CRITERIA FOR FROZEN PIZZA 24 FIGURE 10 RESEARCH PROCESS 25 FIGURE 11 TOP-DOWN & BOTTOM-UP APPROACHES 28 FIGURE 12 MARKET DYNAMICS OVERVIEW 31 FIGURE 13 DRIVER IMPACT ANALYSIS 33 FIGURE 14 RESTRAINT IMPACT ANALYSIS 34 FIGURE 15 GLOBAL FROZEN PIZZA MARKET: VALUE CHAIN 36 FIGURE 16 GLOBAL FROZEN PIZZA MARKET: SUPPLY CHAIN 38 FIGURE 18 GLOBAL FROZEN PIZZA MARKET, BY CRUST TYPE, 2020 (% SHARE) 42 FIGURE 19 GLOBAL FROZEN PIZZA MARKET, BY CRUST TYPE, 2019–2028 (USD MILLION) 42 FIGURE 20 GLOBAL FROZEN PIZZA MARKET, BY CATEGORY, 2020 (% SHARE) 47 FIGURE 21 GLOBAL FROZEN PIZZA MARKET, BY CATEGORY, 2019–2028 (USD MILLION) 47 FIGURE 22 GLOBAL FROZEN PIZZA MARKET, BY SIZE, 2020 (% SHARE) 50 FIGURE 23 GLOBAL FROZEN PIZZA MARKET, BY SIZE, 2019–2028 (USD MILLION) 50 FIGURE 24 GLOBAL FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2020 (% SHARE) 54 FIGURE 25 GLOBAL FROZEN PIZZA MARKET, BY DISTRIBUTION CHANNEL, 2019–2028 (USD MILLION) 54 FIGURE 26 GLOBAL FROZEN PIZZA MARKET, BY REGION, 2019–2028 (USD MILLION) 58 FIGURE 27 GLOBAL FROZEN PIZZA MARKET, BY REGION, 2020 (% SHARE) 59 FIGURE 28 NORTH AMERICA: FROZEN PIZZA MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 60 FIGURE 29 EUROPE: FROZEN PIZZA MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 67 FIGURE 30 ASIA-PACIFIC: FROZEN PIZZA MARKET SHARE, BY COUNTRY, 2020 (% SHARE) 79 FIGURE 31 REST OF THE WORLD: FROZEN PIZZA MARKET SHARE, BY REGION, 2020 (% SHARE) 90 FIGURE 32 NESTLÉ S.A.: FINANCIAL OVERVIEW SNAPSHOT 102 FIGURE 33 NESTLÉ S.A.: SWOT ANALYSIS 103 FIGURE 34 MCCAIN FOODS LIMITED: SWOT ANALYSIS 107 FIGURE 35 DR. OETKER GMBH: SWOT ANALYSIS 110 FIGURE 36 DAIYA FOODS INC.: SWOT ANALYSIS 113 FIGURE 37 PALERMO VILLA, INC.: SWOT ANALYSIS 116 FIGURE 38 THE SIMPLY GOOD FOODS COMPANY: FINANCIAL OVERVIEW SNAPSHOT 118 FIGURE 39 THE SIMPLY GOOD FOODS COMPANY: SWOT ANALYSIS 119 FIGURE 40 GENRAL MILLS INC.: FINANCIAL OVERVIEW SNAPSHOT 120 FIGURE 41 GENRAL MILLS INC: SWOT ANALYSIS 121 FIGURE 42 CONAGRA BRANDS INC.: FINANCIAL OVERVIEW SNAPSHOT 124 FIGURE 43 CONAGRA BRANDS, INC: SWOT ANALYSIS 126